TAKE

THE

DIVE

Unrivalled

Business Intelligence for the

Caribbean & Central America

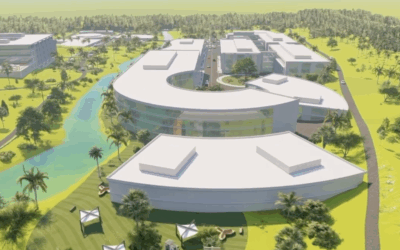

ABOUT COLIBRI

Colibri Advisory helps corporations and investors navigate business in the Caribbean, Central America and Northern Latin America with confidence and in real-time, allowing them to make strong, well-informed commercial decisions. Colibri Advisory is a trust source for strategic advisory services, business intelligence, due diligence, compliance, ESG, investing and market entry services.

A publisher of business news since 1974, Colibri offers its clients:

- Best in class locally-sourced information and business intelligence about projects, business partners and finance origination

- Decades of experience advising international and regional businesses on transactions and investments

- Unrivalled regional network across 37 jurisdictions of trusted on-the-ground associates

- Deep knowledge of local markets and access to local and international business and investor networks

- Full-time specialist staff and panel of senior advisers with specialist knowledge of key industrial sectors

Learn more about us

Grow your business with Colibri Advisory

Colibri has supported investors and companies in 100 investment projects in the region over the last two years –

nearly one per week.

OUR SERVICES

Colibri provides highly reliable, granular, competitive intelligence combined with strategic insights and analysis.

Advice is thorough, well-considered, and frank, offering fresh perspectives and actionable solutions to the real-world challenges clients face.

We provide our clients with high-quality strategic corporate advisory services and information which enables them to make commercial and investment decisions with confidence. Discover our corporate advisory services, market entry and growth programmes, market intelligence, strategy & risk, ESG & impact investment, and compliance & due diligence solutions.

Discover our Market Intelligence Exporter Services.

Broaden your business horizons with Colibri’s bespoke Market Entry and Growth Programmes.

MARKET INTELLIGENCE

Sector mapping

Market entry

Competitor Intelligence

Investment identification

Regulation, tax and tariffs

Business development support

STRATEGY AND RISK

Representation and Advocacy

Dispute Resolution

Political Risk Forecasting

Strategy / Scenario Formulation

Investment advisory

Finance origination

ESG / IMPACT INVESTMENT

Materiality Measures

Risk Mitigation

Impact Investing

Stakeholder mapping

Culture and Values

ESG Solutions

COMPLIANCE DUE DILIGENCE

Reputational Risk

Security Risk Analysis

Investigations and EDD

Anti-Corruption

Compliance

Post-transaction support

OUR CLIENTS

Colibri provide advisory services to multinational corporations, investors and financial advisors including leading international accountancy and law firms, corporate intelligence firms, investment banks, private equity houses and fund managers.

Sectors include pharmaceuticals, agroprocessing, FMCG, energy, oil and gas, telecoms, mining, ports, shipping and tourism.

For more information on our sector capabilities and our regional coverage. Click here.

Capabilities by jurisdiction

We offer coverage for 37 jurisdictions in the Caribbean, Central America and Northern Latin America.

Anguilla

Antigua & Barbuda

Aruba

Barbados

Belize

Bermuda

Bonaire

British Virgin Islands

Cayman Islands

Cuba

Dominica

Dominican Republic

French Guyana

Grenada

Guadalupe

Guyana

Haiti

Jamaica

Martinique

Montserrat

Netherlands Antilles

Puerto Rico

St Kitts & Nevis

St Lucia

St Maarten

St Vincent and the Grenadines

St. Barts

Suriname

The Bahamas

Trinidad & Tobago

Turks & Caicos

U.S. Virgin Islands

Costa Rica

El Salvador

Guatemala

Honduras

Nicaragua

Panama

Clients have included:

LATEST ANALYSIS

Construction fuelling Grenada’s economic growth – IMF

Construction fuelling Grenada’s economic growth - IMF Grenada’s economy is showing resilience post-Hurricane Beryl, with construction driving growth amid slowing tourism. The IMF projects GDP to rise 4.4% in 2025, up from 3.3% in 2024, supported by...

Anguilla named safest Caribbean Island

Anguilla named safest Caribbean Island. Anguilla has been ranked the safest Caribbean destination for 2025 by World Population Review, thanks to its low crime rates, political stability, and secure environment. Its small size, limited...

Oil and gas discovery in Montecristi

Oil and gas discovery in Montecristi. BSD Global Exploration has announced the discovery of significant oil and natural gas deposits in Montecristi, northwest Dominican Republic, using advanced 3D seismic and proprietary remote sensing...

Guyana government announces plan to overhaul financial system

Guyana government announces plan to overhaul financial system - Guyana’s government has unveiled an ambitious plan to modernise and tighten the country’s financial system, introducing new foreign exchange controls, banking oversight, and a...

Offshore banks under threat

Offshore banks under threat. Prime Minister Gaston Browne has warned that one or two offshore banks in Antigua and Barbuda may be liquidated due to difficulties maintaining correspondent banking relationships. Speaking on Pointe FM, Browne...

UK raises its financing capacity for Guyana

UK raises its financing capacity for Guyana. The UK Export Finance agency (UKEF) has raised Guyana’s credit limit from £2.1bn to £3bn (~US$3.8bn), expanding access to financing for major infrastructure projects. President Irfaan Ali said the...

Contact Us

"*" indicates required fields